We are maintaining our “Buy” rating on Hilton Worldwide Holdings Inc. (HLT) and leaving our target price at $340. We believe that a recovery in business and leisure travel will lead to increased room demand, along with unit expansion and higher management fees, advises John Staszak, analyst at Argus Research.

Our long-term rating on HLT remains “Buy” based on the company’s solid development pipeline, new brands, and highly regarded loyalty program. We also expect earnings to benefit from the spinoff of the timeshare businesses and the sale of additional company-owned hotels.

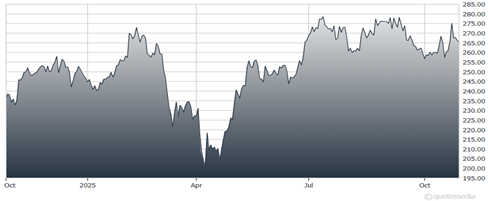

Hilton Worldwide Holdings Inc. (HLT)

On Oct. 22, Hilton reported 3Q25 operating EPS of $2.11, up from $1.92 a year earlier and above management’s guidance of $1.98-$2.04 per share. The consensus estimate had called for operating EPS of $2.05.

Third-quarter adjusted EBITDA rose to $976 million from $904 million in 3Q24. The consensus estimate had called for EBITDA of $953 million. The EBITDA margin was 31.3%, down 20 basis points from the prior-year period. The consensus estimate had called for an adjusted EBITDA margin of 31.6%.

Primarily reflecting higher franchise and licensing fees, overall revenue rose 8.8% to just over $3.1 billion. The consensus estimate had called for revenue of $3.01 billion. Revenue per available room (RevPAR) fell 110 basis points from the prior year on lower room rates and decreased occupancy.

In the third-quarter press release, Hilton raised most of its 2025 forecasts. Hilton also raised the lower end of its unit growth target to 6.5% -7% from 6%-7%. The improvement in net unit growth appears to reflect management’s ability to add new rooms on time and an acceleration in converting independent hotel operators to the Hilton brand.

Based on prospects for solid unit growth, ongoing demand for travel, and opportunities to convert current hotel owners to the Hilton brand, we are leaving our 2025 estimate at $8.54 and raising our 2026 estimate to $9.20 from $9.12.