Bitcoin just fell below $100K for the first time since the summer, while the Nasdaq 100 fell 2%. But Palantir Technologies Inc. (PLTR) led the market lower after bearish bets clouded its bull run, writes Tom Bruni, editor-in-chief of The Daily Rip by Stocktwits.

Palantir fell after yet another beat-and-raise Monday night, so there had to be a good reason. Turns out if you’re the most expensive stock trading on the S&P 500 Index (^SPX) based on your forward earnings multiple, it doesn’t take much to set off a selling spree.

(Editor’s Note: Tom will be speaking at the 2026 MoneyShow/TradersEXPO Las Vegas, scheduled for Feb. 23-25. Click HERE to register.)

PLTR was down after “Big Short” hedge fund manager Michael Burry said he bought long puts on Palantir and Nvidia Corp. (NVDA). Filings don’t show shorter options if the strategy is part of a spread. Burry was waxing about market bubbles just a couple days ago, posting a screenshot of Christian Bale playing him in the movie The Big Short. Cringe.

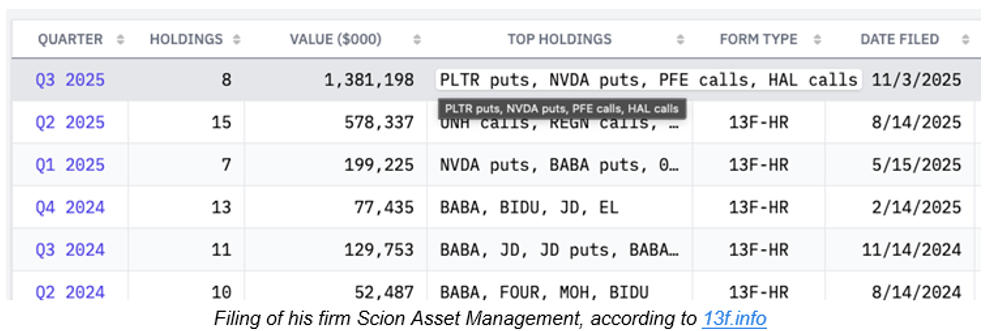

Burry’s firm showed in a 13F filing puts on Palantir and Nvidia, alongside calls on Pfizer Inc. (PFE) and Halliburton Co. (HAL). The long-dated puts show the “nominal value” of the shares the options contracts control, not what Burry and gang paid.

The $912M for PLTR and $186M for Nvidia puts dated Sept. 30 likely cost a whole lot less, and are a part of an unknown strategy — 13F filings don’t require short-term options.

Burry rose to fame by correctly betting on the mortgage crisis in the 2000s. But he has since made a name for himself by calling the end times a little more often than they actually occur. In January 2023, he tweeted “sell”...and the markets are up 78% since then.