Much to the surprise of many investors, 2025 may turn out to be another great year for the US equity markets. That would buck the likelihood that the S&P 500 Index (^SPX) would not score a “three-peat,” or a third successive double-digit gain. Naturally, investors wonder if 2026 will see a fourth year of double-digit gains. Here’s my take, writes Sam Stovall, chief investment strategist at CFRA Research.

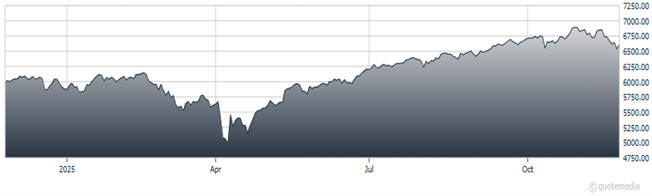

Year to date through Nov. 21, the S&P 500 rose more than 12%, even after declining by 19% early in the year on fears of a recession from a possible global trade war. The S&P 500’s gain was driven by the Federal Reserve restarting its rate-reduction cycle plus better-than-expected earnings gains, led by Artificial Intelligence (AI)-related companies.

(Editor’s Note: Sam is speaking at the 2025 MoneyShow Masters Symposium Sarasota, scheduled for Dec. 1-3. Click HERE to register.)

S&P 500 Index (^SPX)

Both benchmark styles advanced, along with 10 of the 11 sectors in the S&P Composite 1,500. Markets were led by communication services, information technology, and utilities; laggards included consumer discretionary, consumer staples, and real estate. In addition, 53% of the 155 subindustries rose in price, led by diversified metals and mining, gold, and electronic components.

Even though we think the bull will remain intact by year-end 2026, we project increased volatility along with a lower-than-average full-year percentage increase. Our 2026 year-end target for the S&P 500 is 7,400, implying a 5.7% price increase on top of the projected advance to 7,000 by year-end 2025.

Our hypothetical moderate allocation consists of 45% US equities, 15% international stocks, 20% bonds, 5% commodities, and 15% cash.