Stocks surged yesterday, and they’re showing subdued gains in early trading today. Gold and silver are up a bit, too, while crude oil is flat. Treasuries and the dollar are mostly unchanged.

As a reminder: All US markets are closed on Thanksgiving, while the stock and bond markets will have abbreviated trading sessions on Friday. Historically, the S&P 500 Index (^SPX) has traded higher 60% of the time Tuesday-Friday of Thanksgiving week.

We’ve seen a BIG swing in expectations for the Federal Reserve’s December policy meeting. After toning down bets on another 25-basis point cut, traders have piled into positions that would profit if the Fed moved again before year end. Futures markets are now pricing in an 80% chance of another cut, versus around 30% a few days earlier. Weaker job market data and dovish Fed speeches and interviews have helped shift sentiment – and fuel stock market gains.

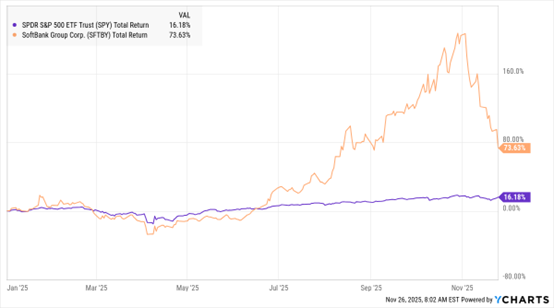

SPY, SFTBY (YTD % Change)

Data by YCharts

Most Artificial Intelligence (AI) stocks have slid from their October peaks, but Softbank Group Corp. (SFTBY) of Japan has been one of the hardest-hit. The investment firm has large stakes in both public and private tech and AI companies, and its shares have tanked 40% in the last several weeks.

The firm just finished the $6.5 billion acquisition of a US chip company called Ampere Computing. It also has a $32 billion deal to fund operations at OpenAI – a deal that requires it to pony up $22.5 billion in December. Still, mega-bank HSBC just published a 7,500 S&P 500 target for year-end 2026, partially citing the likelihood of an ongoing buildout of AI infrastructure. That underscores the intense nature of the AI "boom vs. bubble" debate.